Consumer Duty Obligations: Advising the Baby Boomer Generation

15 February 2024

First seen on Professional Adviser

First seen on Professional Adviser

Despite governments steadily raising the age at which individuals qualify for their state pension, there is no hiding that the Baby Boomers, the population bulge born between 1946 and 1965, are coming through to retirement in ever greater numbers.

Despite governments steadily raising the age at which individuals qualify for their state pension, there is no hiding that the Baby Boomers, the population bulge born between 1946 and 1965, are coming through to retirement in ever greater numbers.

Close to two thirds of a million people now reach state pension age each year.

Baby Boomers working beyond retirement age

What we are seeing at an individual level is Baby Boomers using three of the major reforms of the coalition government led by David Cameron and Nick Clegg from 2010 to 2015. It was this government which passed the Employment Equality (Repeal of Retirement Age Provisions) Regulations 2011. These regulations enabled most workers to stay on beyond what would have been their retirement age, should they wish, with a few exceptions.

Dunstan Thomas' last round of market research with Baby Boomers during 2022 found that 23% of Baby Boomers wanted to work on full-time beyond state pension age. This represented a considerable increase on the 15% who, in Dunstan Thomas' 2017 study, had expressed this same wish. This group are particularly vulnerable to de-risking their pension fund too soon.

They may not appreciate the importance of reviewing their investment strategy to realign it with their later retirement intention. However, under the new Consumer Duty there seems to be a clear obligation on either their adviser or their provider to draw this factor to their attention, or they could needlessly suffer the loss of several valuable growth years of investment.

The second reform, the 'Children and Families Act 2014' extended the right to ask an employer for part-time work to everyone, not just those with ‘children and families'. The right is only to ask, the employer obligation is only to consider the request seriously. The act has spawned increasing numbers of part-time and ‘job share' opportunities. Returning to our Baby Boomer research again, 47% told us that they wanted to work on part-time beyond state pension age - an increase of 5% on the figure we found five years previously.

This group really need help understanding the rules around the money purchase annual allowance (MPAA). It might seem quite natural for them draw a pension to cover Mondays and Fridays and to work on Tuesdays through to Thursdays - contributing to their workplace pension on those working days, especially if there is an employer contribution up for grabs. However, the much-hated MPAA was not one of HM Revenue & Customs' finer inventions, and again Consumer Duty perhaps now requires advisers and/or providers to ensure that clients know how not to trigger these often unexpected tax charges.

Baby Boomer early retirement

The coin has a flip side too. Whilst 70% of Baby Boomers want to work on longer, many of the other 30% are retiring early. And the third of the coalition reforms, pension freedom, enables them to finance early retirement by perhaps cashing in a small defined contribution (DC) pension to bridge the years before a major defined benefit (DB) pension becomes payable.

Here they may need urgent help, as cashing in a whole pension pot in March could propel them into a higher tax band. Yet this can be avoided by withdrawing it in two chunks, either side of the end of tax year divide. The Consumer Duty will again require advisers and providers to be alert to this sort of avoidable harm - steering savers around common pitfalls.

I only wish it applied to employers too! I have seen so many employers, and especially HR departments, simply show staff the hand and declare: "We can't give any help with your personal taxation", even though it's their policies and their pension scheme that may be creating a tax nightmare.

There is always a bit of a danger with consumer surveys that an unconscious bias, to give the answer that might please or impress the questioner, is offered up by the respondent - perhaps colouring or even concealing their true intentions.

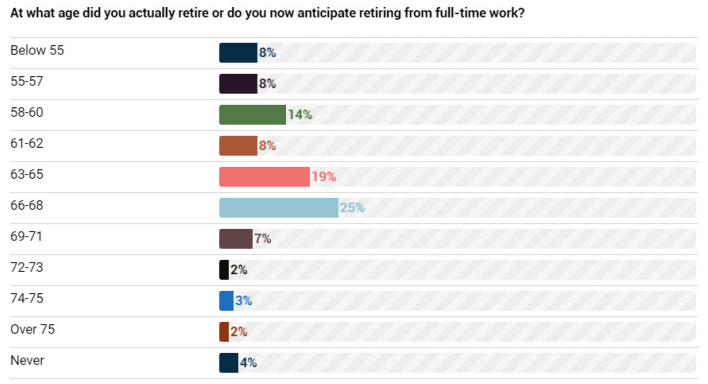

So, as well as asking about their desire to work on (and so appear admirably industrious), we also produced a composite picture merging future intentions with past actions. This gave us a more reliable view of what age Baby Boomers are actually retiring at:

Dual 'At retirement' markets

It was pointed out to me in a recent Chatham House Rules meeting (so I can't tell you the name of the clear-thinking person who lit this particular light bulb for me), that today we are now seeing two ‘at retirement' markets. The first one is at, or shortly after, age 55 and involves a review, often a consolidation of multiple pots into one or two plans and taking a bit of tax-free cash. Because those late 50s are a great age to take an exotic holiday or indulge a passion like buying a classic car.

The second 'at retirement' market happens maybe ten years later when work is either completely or largely given up and a ‘fuller' retirement income commences.The important point here is that the choices that will be made available at the second ‘at retirement' event are going to be framed by the scheme that the individual chose to consolidate onto at the first ‘at retirement' event.

For example, some platforms have the capability to house an annuity tax-efficiently inside an income drawdown plan, whilst others don't. If this sort of product combination looks as if it might be suitable for an individual at a later event, then maybe at that first event Consumer Duty suggests it makes sense to alert would-be retirees which platforms offer these hybrid decumulation options. I'm sure there are many other factors like this, but a little advance thinking early on could maximise the chances of the saver being able to secure the best options when they do eventually retire, without the hassle or delay of having to switch platforms at retirement.

Falling use of financial advice for Baby Boomers

Despite the growing minefield that is optimisation of income in retirement, Dunstan Thomas' own 2022 market research of Baby Boomers found that just a quarter (25%) of 58-75-year-olds planned to or had already used regulated financial advice to gain more knowledge about pensions before they fully retire.

A further 15% planned to, or had already used, guidance services from the likes of Citizens Advice Bureau and Pension Wise services. Some 6% planned to use digital services including ‘live chat and other PC-based communications techniques such as online planning tools and platforms'. Just under 15% derived their pensions knowledge from reading the personal finance pages of the national newspapers.

More interestingly, answers to a separate question uncovered the finding that 37% of Boomers had used a financial adviser at some point in their working lives, indicating that a much larger group of Boomers have already been convinced about the value of regulated advice in order to get a professional, third party opinion on financial planning matters. However, many of these historical advice experiences will have been supported by tied agents in the era of provider-employed Direct Sales Forces pre-Retail Distribution Review before the advice gap emerged.

As time unfolds, we will come to understand how the Consumer Duty changes the relationship between advisers and providers. I don't think advisers will be able to fall back on the belief that the provider's literature contains everything a client needs to know. This is particularly true for the more disengaged amongst their client bank. If the adviser is still taking a fee, then they will have to push themselves in front of clients and ensure that periodic reviews are done. Otherwise, the passage of time will unpick the balance the adviser originally established between client needs and solutions.

Similarly, I don't think that providers can simply assume that where there is an adviser, it is the adviser who holds the responsibility. The regulator sees it as a rather more joint and several liability than that. At times the Consumer Duty may lead to tensions between advisers and providers over who is saying what to the client. But when they work well together, each will assist the other in fulfilling their duties by the regulator.

Adrian Boulding

Director of Retirement Strategy at Dunstan Thomas

023 9282 2254

enquiries@dthomas.co.uk